Introduction

Modernization of credit risk assessment is putting more pressure on banks in the contemporary era where market instability, online lending, and regulatory oversight keep growing. Mature credit risk models based on fixed rules and past assumptions are not capable of keeping up with the dynamic behavior of borrowers and the dynamic aspects of the economy.

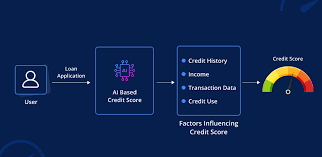

This is the reason AI credit risk models are becoming popular in the industry. Automated credit risk analysis helps to make faster, more precise credit decisions, increase risk visibility, portfolio resilience, and long-term financial stability through the use of cutting-edge data analysis and automation in contemporary banking settings.

According to a report by Mckinsey, 80% of the credit risk modelling organizations are already planning to integrate generative AI into their operations. The statistics well demonstrate the efficiency of technology in financial organizations.

Understanding Traditional Credit Risk Models

What Are Traditional Credit Risk Models?

- Scorecard-based and rule-driven approaches

Conventional models are based on predetermined scorecards and rigid rules that are used to assess the risk of the borrowers. These methods are not as flexible to be applied to changing market conditions and are only consistent in credit risk modeling in banking industry.

- Reliance on historical financial and bureau data

Judging of credit risks among banks is mostly pegged on historical financial report and credit bureau records thus constraining proper credit risk judgment in the banks in scenarios whereby the conduct of the borrower or the economic environment is undergoing a quick change.

Common Types of Traditional Models

- Logistic regression models

Comparisons between statistical techniques of approximating default risk based on fixed variables in traditional vs AI credit risk models.

- FICO-based scoring systems

Uniform bureau scores in favor of baseline decisions.

- Rule-based underwriting frameworks

There are predetermined rules that restrict flexibility in assessing credit risks in banks.

Limitations of Traditional Credit Risk Models

- Fixed logic cannot keep up with the dynamics of risk patterns in credit risk modeling in banking.

- The non-conventional information is not utilized, and it has a restricted depth of insight.

- Unrealistic thresholds limit the lending opportunities.

- Time lag in updating undermines the effectiveness of automated credit risk analysis.

The Rise of AI-Powered Credit Risk Models

What Are AI Credit Risk Models?

- Machine learning and deep learning-driven risk assessment

AI is used to assess complex trends in structured and unstructured data to enhance the accuracy of AI credit risk models.

- Dynamic, self-learning risk scoring mechanisms

Models are constantly updated with new data, which makes machine learning credit risk models robust in real-time decisioning.

Key Technologies Powering AI Credit Risk Models

- Machine Learning (ML) & Deep Learning

Complex patterns that would not be identified in traditional statistics are identified using algorithms.

- Predictive Analytics

Estimates default risk with future-looking information.

- Alternative Data Processing

Enables the use of unconventional data in a more insightful manner to generate more accurate results.

- Explainable AI (XAI) for Compliance

Guarantees clarity in AI credit risk models, which helps in credit risk assessment in banks.

Traditional vs AI Credit Risk Models: A Comparative Analysis

Model Accuracy and Predictive Power

| Aspect | Static Statistical Models | Adaptive Learning Systems |

| Accuracy | Limited, assumption-driven | Higher, data-driven |

| Predictive Power | Reactive, historical | Proactive, real-time |

This comparison highlights traditional vs AI credit risk models, where adaptive systems enable stronger credit risk assessment in banks.

Data Utilization

| Aspect | Limited Financial Data | Multi-Source Alternative Data |

| Data Utilization | Restricted to historical records | Broader, real-time insights |

This change makes credit risk modeling in banking more robust by providing more rich inputs with machine learning credit risk models.

Speed and Automation

| Aspect | Manual Review Cycles | Real-Time Credit Decisioning |

| Speed | Slow, time-intensive | Instant, scalable |

| Automation | High human dependency | Fully automated |

AI in credit risk modeling enhances credit risk evaluation in financial institutions by automation of credit risks.

Risk Coverage and Bias Reduction

| Aspect | Narrow Risk Visibility | Holistic Borrower Profiling |

| Risk Coverage | Fragmented insights | Comprehensive view |

| Bias Reduction | Higher bias risk | Reduced bias via data diversity |

This is the difference between traditional vs AI credit risk models, which promotes equity in the credit risk modeling in banking.

Regulatory Compliance and Transparency

| Aspect | Rule Explainability | Explainable AI Frameworks |

| Regulatory Compliance | Basic, rule-focused | Advanced, audit-ready |

| Transparency | Static logic | Model-level insights |

This analogy favors AI credit risk models and enhances credit risk in banks.

Business Impact of AI Credit Risk Models for Banks

Improved Credit Approval Rates

The AI-powered models will help banks to better determine the risk of the borrower through the analysis of different and granulated data. Credit risk modeling in banking enabled by AI unlike strict traditional systems identifies creditworthy customers who would otherwise have been shut out, enhances approvals without raising risk exposure.

Reduced Defaults and NPAs

The high-level pattern recognition will enable prompt detection of problematic borrowers and warning signs. Using AI credit risk models, banks are in a position to employ preventive measures, including repricing, restructuring, or increased monitoring, which will greatly mitigate defaults and the accrual of non-performing assets.

Faster Loan Processing

Automation gets rid of manual reviews and long approval. Real time decisioning aids in the rapid disbursement of loans whilst ensuring accuracy enhances customer experience and operational efficiency by the automated credit risk analysis.

Smarter Portfolio Risk Management

AI constantly checks the performance of the portfolio, identifies the risk of concentration, and models the stressful situations. This facilitates proactive rebalancing and data-driven policies, which allow banks to have resilience in their portfolios, ensure efficient allocation of capital, and promptly react to the emerging market and borrower dynamics.

Key Considerations Before Modernizing Credit Risk Systems

Data Readiness and Quality

Modernization is achieved through well-managed data. Banks need to evaluate completeness, consistency, and accessibility of data both internal and external. Even high-tech AI credit risk models might deliver false or prejudiced results when using unclean and fragmented datasets.

Model Explainability & Regulatory Compliance

The regulators are always asking the banks to be transparent in its decisions on credit. The model has to be interpretable, auditable and aligned with the local and global regulations in institutions. Explainability is essential to ensure trust, show fairness and enable effective credit risk assessment in banks.

Technology Infrastructure

Olden-day systems tend to be restrictive to scalability and real time processing. Banks are supposed to review the questions on their infrastructure capability to embrace the cloud, API connections, and high-volume data processing required in the new risk analytics and automation.

Change Management and Skill Readiness

Modernization is not only technical, but it is an organizational one. It is necessary to educate risk teams, compliance officers, and business stakeholders to trust AI-driven insights and understand them. Well-integrated change management preconditions ease of adoption, low resistance and the greatest long-term value of intelligent credit risk transformation efforts.

Hybrid Approach: Combining Traditional and AI Models

● Why Banks Don’t Need to Abandon Legacy Systems Overnight

In the case of the majority of banks, the core lending and risk systems were developed over decades and are inseparable parts of the daily routine. It is dangerous, costly and disruptive to replace them in the short run. A hybrid method enables institutions to retain established frameworks in the credit risk modeling in banking industry but gradually advance the process through intelligence and automation.

● Using AI as a Decision Support Layer

AI does not have to substitution capabilities that can be applied as a decision support or supplementary layer to current models. With this, by supplementing the existing scorecards with machine learning credit risk models insights, banks are able to obtain a more insightful understanding of the borrower, enhanced risk differentiation, and increased confidence in their credit decision-making without regulatory familiarity being compromised.

● Gradual Modernization Strategies for Risk Transformation

Effective change occurs in stages. Pilot applications that banks can initiate include pre-screening, early warning signals or portfolio monitoring, and expand the use of AI over time. The incremental strategy allows the teams to test the performance, make sure it is exercised, and establish internal trust. Through the integration of stability through the legacy and agility by AI, institutions will be able to modernize responsibly and attain long-term efficiency, resilience, and smarter credit risk outcomes.

Real-World Use Cases of AI Credit Risk Models

● Retail Lending and Personal Loans

AI is also able to increase the quality of the borrower analysis through the examination of income trends, expenditure, and repayment history in real time in the context of retail banking. This enhances the accuracy of approval and inclusion and improves the credit risk modeling in banking of large volume of personal loans.

● SME and MSME Credit Assessment

Small businesses do not have long history of credit and therefore traditional evaluation is not possible. With AI, there is more precise decision-making with the use of cash flow information, transaction patterns, and other signals to access credit more easily due to advanced credit risk evaluation in banks.

● Digital Lending and BNPL Platforms

Digital lending models are dependent on speed and scale. The AI allowed instant approvals, running risks scoring, and active monitoring, which gives platforms to run exposure efficiently and retain the seamless customer experience through intelligent automation.

● Corporate Credit Risk Evaluation

In the case of big companies, AI is used in scenario analysis, stress tests, and early warning systems. AI credit risk models are used to predict the presence of credit risk, allocate credit limits, and handle concentration risks using automated credit risk screening by processing complicated financial frameworks and market indicators to assist banks foresee possible defaulters.

Challenges in Adopting AI Credit Risk Models

● Data Privacy and Security Concerns

The systems based on AI are dependent on abundant sensitive records of customers and transactions. To avoid breach, banks should ensure that there is high data governance, encryption, and access controls. A lack of strong protection may result in exposing privacy breaches and cybersecurity threats when AI credit risk models are implemented.

● Model Bias and Fairness Issues

The biases of historical or incomplete data may be unintentionally carried to the AI system. Otherwise, this can culminate into unfair lending and damage to reputation. It is important to ensure that credit risk assessment by banks is done in a way that is fair, which is regularly tested and based on logic.

● Integration with Core Banking Systems

There are several banks with legacy core infrastructure, which was not intended to support real-time analytics or AI integration. Relating between the current workflows and modern models may be complicated, and it may also necessitate middleware, APIs, and wise change management to prevent an operational break.

● Regulatory Acceptance and Audit Readiness

Regulators require accountability, traceability and explainability in credit decisions. Intelligent automation should have an audit trail of AI and be in accordance with the current and upcoming regulations. Banks can not be easily audited and supervised without the documentation and explainable outputs.

How A3Logics Helps Banks Modernize Credit Risk Models

As a leading AI development company, A3Logics assists banks throughout the entire modernization process by creating and implementing intelligent and scalable credit risk systems that suit the business requirements of the bank. A3Logics is also assured of transparency, fairness and regulation at each step, whether it is custom AI credit risk models, or explainable AI frameworks.

The team facilitates the smooth fit with the core banking systems and LOS/LMS systems and causes minimum disturbance to the operational processes. Through a combination of domain knowledge, sophisticated analytics, and automation, A3Logics assists institutions with fintech software development services to increase the accuracy of decisions, expedite approvals, and make automated credit risk analysis a stronger instrument, providing end-to-end transformation to strategic planning all the way to enterprise-level deployment.

Conclusion

At a time when banks face more and more market volatility and digital disruption, making the right decision on modernization is vital. Knowledge of the disparity between the legacy methods and intelligent systems will allow making informed decisions regarding transformation. Through adoption of traditional vs AI credit risk models, institutions are able to strike the balance between stability and innovativeness as well as minimizing risk exposure. The current credit models that operate through data intelligence, automation, and explainability provide quicker decision-making, reduced defaults, and enhanced compliance.

When applied intelligently, AI-based solutions can make the system more resilient without harming regulatory trust. To remain competitive, advanced credit risk modeling in banking is not an option to banks anymore, but a necessity of sustainable growth, intelligent lending and financial strength in the long term.